Q1 2025 Market Commentary – Marco Goco, Associate Portfolio Manager

Markets have been in correction territory through Q1 2025. That dip reached just under 10% from absolute highs to lows in Q1. The retracement is unpleasant but certainly not unprecedented. Political headlines have continued to bombard investors, forcing news commentary to turn very negative. In these times, investors, like pilots, should be monitoring their gauges to ensure they are tactical and adjust their levers accordingly. Sea Glass Wealth Advisory Group’s proactive pension-style portfolio management philosophy focuses on reducing volatility while providing stable income and sustainable growth.

Change in Global Trade Policy

President Trump’s tariff policy involved imposing taxes on goods imported from countries such as China, Canada, Mexico, and many others. These tariffs made imported items more expensive, which caused uncertainty and nervousness in the stock markets. In February, the inflation rates in the United States and Canada were around 2.8% and 2.6%, respectively, indicating a heightened level of inflation. Commodities like gold are at an all-time high, another indication of higher inflation.

The price of gold reached a level comparable to the 2020 COVID-19 pandemic, as shown on the chart above. Investors became cautious, resulting in market declines. Additionally, the higher costs for businesses due to these tariffs slowed down economic growth and sometimes led to job cuts. Overall, these factors created a challenging environment for both investors and companies.

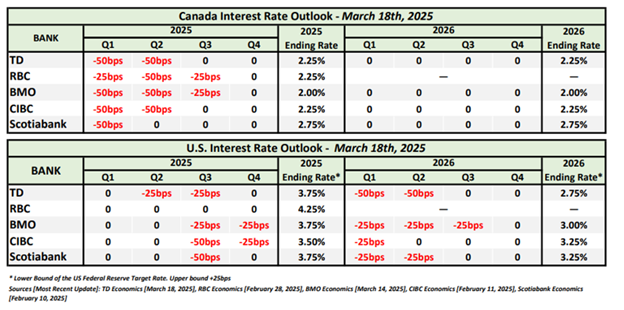

The decoupling of global free-trade policy is a new reality that compels countries to shift their economies rapidly. As a result, we anticipate a lower economic growth rate and additional interest rate cuts by central banks worldwide. The chart at the top illustrates the interest rate outlook by the major Canadian banks.

Sea Glass Wealth Advisory Group closely analyzes the Bank of Canada reports and interest rate announcements. They meet eight times a year to announce their interest policy. If you are considering consolidating your debts or need advice on renewing your mortgage, we are available to assist you.

In recent months, tech and growth stocks have been underperforming. A significant recent development is the emergence of DeepSeek, a Chinese AI startup. DeepSeek’s advanced AI model has outperformed many of its U.S. counterparts, resulting in a substantial sell-off in U.S. tech stocks. This disruption has shaken investor confidence in established tech giants, leading to further declines in their stock valuations. Nevertheless, valuations of U.S. stocks remain high. After two years of substantial gains, the US market is now experiencing more muted growth.

There is a shift in investor behavior, with a rotation from U.S. equities to international equities.

U.S. equities have reached high valuations, making them less attractive to investors seeking better value. European and Asian stock valuations are more attractive now. As a result, Sea Glass Wealth Advisory Group proactively reduced its exposure to US stocks and increased its exposure to international stocks in Q1 2025.

Finding opportunities in a market crisis!

Sea Glass Wealth Advisory Group focuses on proactive pension-style portfolio management, seeking investment opportunities in all market cycles. When fear prevails in the markets, it offers opportunities for you. Market uncertainty and dislocations will present entry points for new investments. We have purposely kept cash available to take advantage of the situation, and the second half of 2025 might be the time to implement this cash in your portfolio.

Portfolio Outlook and Positioning

Equities – Target Weight

- USA Equities – reduce exposure to growth stocks

- Canada Equities – reduce exposure and rotate to high-quality with dividend income

- International Equities – Increase exposure to high-quality international equities.

- Small-Cap Equities – Rotate out of US Growth Small-Cap to Global Value Small-Cap. There is significant price dislocation, presenting numerous buying opportunities.

Fixed Income – Target Weight

- Canadian Bonds – Focus on high-quality, lower-duration bonds

- US Bonds – Focus on high-quality, lower-duration bonds. Underweight US bonds to reduce foreign currency risk.

- Liquid Absolute Return – Maintain positions with portfolio managers who have a proven track record.

Private Market Securities – Target Weight

- Private Real Estate & Infrastructure – Cautious on discretionary retail, student housing, and industrial. Focus on essential real estate and infrastructure with investment-grade tenants.

- Private Credit – Focus on private credit pool with collateralized loan (1st position loans).

- Private Equity – Focus on secondary markets for more liquidity.

Changes in Portfolio Positioning Over Q1 2025

- Reduced growth equities and moved to higher quality with dividend focus.

- Increased exposure to international equities.

- Rotated from US small-cap to Global small-cap of high-quality companies.

- Focused on low-duration bonds with limited foreign exchange risk.

- Higher-quality private securities with increased liquidity.

Disclaimer

I, Marco Goco, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

https://seaglasswealth.com/contact/

We are looking forward to the opportunity to meet you! For more information, please feel free to reach out.

- Check out our upcoming events.

- Contact Us for more information on Sea Glass Wealth Advisory Group.

- Find Us on LinkedIn and Facebook.

< Back to Blog Posts

Share this post: