Marco Goco, Dip.T, B.Mgmt, PFP, CIM

Associate Portfolio Manager

A Warm Welcome to 2026

Happy New Year, and thank you for taking the time to review our Q4 Market Commentary.

As we reflect on 2025, one theme defined the global investment landscape: exceptional resilience. Despite Trump tariff policy uncertainty and several periods of volatility, global equities delivered strong returns.

Throughout the year, our priority at Sea Glass Wealth Advisory Group remained clear — protect capital, manage risk proactively, and position portfolios for sustainable long‑term growth. I am pleased to report that SGW’s portfolio mandates generated strong returns in 2025, and importantly, did so with lower volatility.

2025 Market Overview: Resilience Amid Uncertainty

The year opened with the Trump Administration’s tariff and trade shock culminating from steep losses triggered by the Liberation Day tariff announced on April 1. Investors reassessed global supply chains and cross‑border earnings. In Q2, markets recovered quickly, supported by substantial investment in AI and data‑center infrastructure. However, performance was concentrated in a narrow group of mega‑cap technology companies, producing a two-tape market where headline strength masked underlying breadth weakness.

In the second half of the year, markets experienced two notable pullbacks — one in late August and another in late November — as investors rotated out of expensive AI‑related sectors and into other asset classes.

Despite these disruptions, global markets ended the year with strong gains. As we enter 2026, the market narrative is shifting from resilience to execution, with investors increasingly focused on companies’ ability to translate investment into earnings and margin expansion.

SGW’s Proactive Portfolio Management

Our pension‑style investment philosophy emphasizes disciplined risk management and steady long‑term returns. In 2025, this approach guided several timely tactical decisions that helped protect client portfolios during periods of volatility. Below, we will highlight two tactical decisions:

JULY 2025: Reducing North American Equity Exposure

In early July, we identified rising valuation risks in North American equities. On July 3, we reduced exposure to North American equities and increased allocations to high‑quality emerging markets — while intentionally avoiding China to reduce geopolitical and regulatory risk. Below is a quote from SGW’s Q2 Market Commentary:

“A key theme emerging in Q2 is the widening valuation spread between Emerging Markets (EM) and Developed Markets (DM), underpinned by diverging growth trajectories. EM equities continue to trade at a significant discount relative to their DM counterparts, with the EM-DM growth differential now near the upper end of its 10-year range. This divergence is supported by expectations of steady EM economic expansion, particularly in Asia and Latin America, where fiscal and monetary policies remain accommodative.”

Below is a chart illustrating our tactical decision to begin reducing exposure to North American equities on July 3, 2025:

We reduced exposure to North Americal equities in the summer of 2025 and started adding position in quality emerging market. We conducted a comprehensive due diligence process to determine which emerging market investment vehicle was suitable for our strategy. This adjustment allowed us to:

- Move into more attractively valued markets

- Capture stronger growth trends in Asia and Latin America

- Reduce exposure to overheated sectors

November 2025: Strengthening Portfolio Stability

By October, equity valuations appeared stretched. On November 7, we proactively reduced equity exposure again and increased allocations to:

- High‑quality global bonds

- Equity‑income strategies with options to help mitigate downside risk and high yield income.

Below is a quote from SGW’s November 7, 2025 Client Trade Notes:

“The stock market is at an all-time high, and valuations might be overstretched. To be proactive in our risk management portfolio strategy, we are reducing exposure to equities and increasing exposure to fixed income to reduce risk. We are adding Pender Bond Universe, which is designed to protect your portfolio and generate consistent income.”

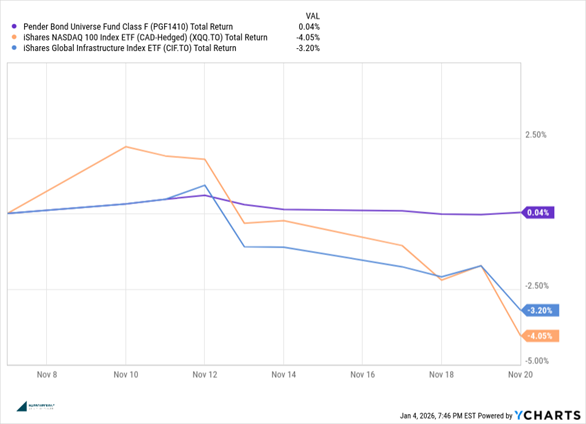

Below is a chart illustrating SGW’s tactical decision on November 7, 2025:

Within weeks, technology and infrastructure equities declined, while our shift toward higher quality fixed income helped stabilize portfolio performance.

These decisions contributed to:

- Lower portfolio volatility

- Smoother returns during market pullbacks

- Outperformance relative to benchmarks

2025 Performance: Strong Results With Lower Volatility

SGW’s portfolio mandates (Conservative‑Income, Balanced‑Income, Balanced‑Growth & Maximum Growth) generated strong returns in 2025.

We achieved this through:

- Reduced exposure to high‑valuation technology stocks

- Proactive tactical adjustments at key turning points

- A disciplined, risk‑aware investment framework

This reflects the core of our pension‑style philosophy: consistent, risk‑managed performance across market cycles.

Portfolio Outlook and Positioning

SGW’s portfolio mandates remain diversified, liquid, and focused on quality. Current positioning includes:

Equities

- International Equities: Quantitative strategies for timely responses to geopolitical developments; no China exposure to reduce volatility.

- Global Small-Cap Equities: Fundamental research to identify mispriced opportunities.

Fixed Income

- Global Bonds: High‑quality issuers with tactical allocation and hedging strategies.

- Liquid Absolute Return: Managed by experienced teams with strong long‑term track records.

Private Markets

- Real Estate & Infrastructure: Cautious positioning in discretionary retail, multi‑family, and industrial sectors.

- Private Credit: No exposure to maintain portfolio liquidity.

- Private Equity: Focus on secondary markets for improved liquidity and pricing.

Changes in Portfolio Positioning in Q4

During the fourth quarter, we:

- Added equity‑income strategies with options to enhance income and reduce downside risk

- Increased exposure to high‑quality global fixed income

- Maintained fundamental global small‑cap exposure

- Continued focusing on international equities with no China exposure

- Reduced exposure to illiquid private securities to preserve flexibility for 2026 opportunities

What This Means for Clients

Your portfolio is positioned to:

- Navigate volatility with greater stability

- Avoid areas of the market with elevated valuation risk

- Capture opportunities as global markets shift toward earnings‑driven growth

- Maintain high liquidity, enabling timely tactical adjustments in 2026

Our commitment to disciplined research, proactive risk management, and pension‑style portfolio construction continues to guide every decision we make.

Looking Ahead

We are pragmatic and proactive about the potential opportunities 2026 may bring and remain dedicated to protecting and growing your wealth with care, discipline, and strategic foresight.

Wishing you and your family good health and prosperity in the year ahead!

Disclaimer

I, Marco Goco, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

https://seaglasswealth.com/contact/

We are looking forward to the opportunity to meet you! For more information, please feel free to reach out.

- Check out our upcoming events.

- Contact Us for more information on Sea Glass Wealth Advisory Group.

- Find Us on LinkedIn and Facebook.

< Back to Blog Posts

Share this post: